The prospect of battle between Russia and NATO international locations over Ukraine has raised fears of an power disaster in Europe. Russia gives almost half of Europe’s pure fuel, and a few leaders fear that Moscow may tighten the circulation if hostilities escape. To weaken Russia’s leverage, the Biden administration is working to safe further fuel shipments to Europe from different sources. International power coverage professional Amy Myers Jaffe explains how a lot fuel is offered and what’s concerned in rerouting it.

How dependent is Europe on pure fuel, and who're its important suppliers?

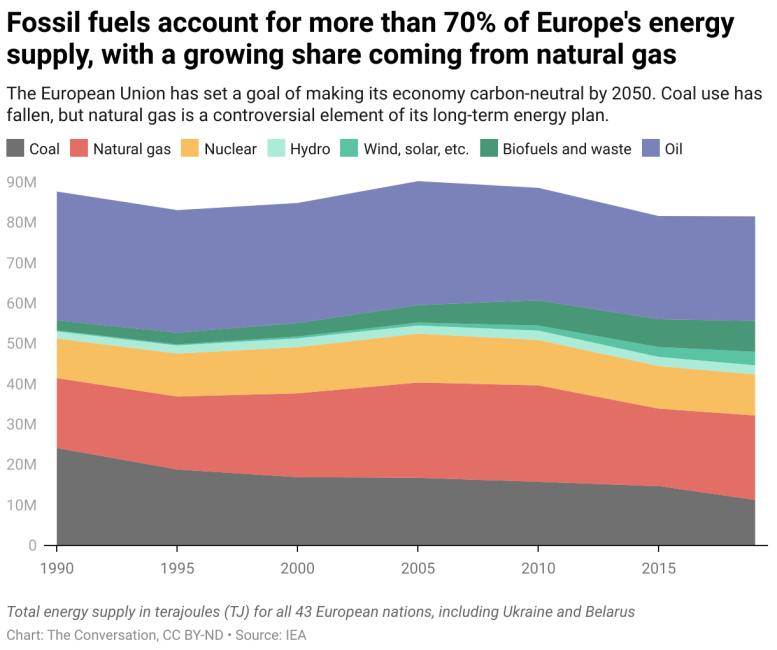

Pure fuel represents about one-fifth of all major power used throughout Europe. It accounts for about 20% of electrical energy technology and in addition is used for heating and industrial processes.

Russia is the most important provider of pure fuel to Europe, sending about 40% of the continent’s provides shipped by pipeline. The following-largest suppliers by way of pipeline are Norway (22%), Algeria (18%) and Azerbaijan 9%. Europe additionally receives pure fuel that's liquefied and delivered by ship.

In current months, European imports of liquefied pure fuel, or LNG, from the U.S. and elsewhere reached file ranges at round 400 million cubic meters per day. To place that in perspective, a single LNG cargo ship can maintain roughly 125,000-175,000 cubic meters of pure fuel – sufficient power to heat 17 million British houses for one winter day.

The EU and the US are collectively dedicated to Europe’s power safety 🇪🇺🇺🇸

The US is our largest LNG provider.

We're collaborating on the availability of further volumes of pure fuel.

Learn the joint assertion by @POTUS and President @vonderleyen ↓

— European Fee 🇪🇺 (@EU_Commission) January 28, 2022

What are the most important constraints for exporters on sending extra fuel to Europe?

LNG is made by cooling pure fuel to minus 260 levels Fahrenheit (minus 162 levels Celsius), which reduces its quantity by a issue of greater than 600. Pure fuel is piped to a port, processed in a liquefaction plant, after which loaded into specialised insulated, temperature-controlled tankers for cargo by sea.

To obtain LNG, an offloading port will need to have a regasification plant that converts the LNG again to a gaseous type so it may be despatched by pipeline to finish customers. Each liquefaction crops and regasification crops price billions of dollars and take a number of years to construct.

Following a related disaster in 2009, when a monetary battle with Ukraine prompted Russia to droop fuel shipments for 20 days, Europe considerably expanded its variety of regasification services to 29. There may be nonetheless presently area in European regasification receiving terminals to import extra LNG, and loads of space for storing to carry imported provide nearly indefinitely. However most of the world’s high suppliers are maxed-out, with little capability to supply and liquefy extra pure fuel than they're already shifting.

The worldwide LNG market has some flexibility. About two-thirds of all LNG is offered underneath agency, long-term contracts with fastened locations. Some main contract holders like South Korea, Japan and China and their suppliers are keen to redirect cargoes to Europe if an extra cutback in Russian exports creates a worsening provide disaster.

A take a look at the U.S.‘s emergence as a serious pure fuel exporter, specializing in the corporate Freeport LNG.

Have suppliers rerouted shipments this fashion earlier than?

The principle instance occurred in 2011 when a tsunami triggered a meltdown and radiation launch at Japan’s Fukushima Daiichi nuclear plant. Japan shut down all of its nuclear crops to evaluate whether or not they have been ready for related disasters. LNG suppliers diverted fuel shipments to Japan to assist it climate the fast disaster.

At present, analysts say that producers or LNG importers could possibly redirect cargoes that would offset about 10%-15% of any shortfall. Nonetheless, such shifts would possible be at premium costs, leaving European shoppers with an excellent steeper invoice than they face now.

Will elevated U.S. LNG shipments to Europe drive up costs for U.S. shoppers?

Current U.S. LNG export services have been operating at full capability for a number of months. About half of U.S. LNG shipments in December 2021 have been destined for Europe, spurred by rising costs in European markets. Beforehand, a bigger share of U.S. LNG exports have been crusing to China, the place drought-related constraints on hydroelectric energy had created a surge in demand for pure fuel.

In different phrases, U.S. sellers have been in a position to provide extra fuel to Europe by diverting export cargoes, fairly than by promoting fuel that will in any other case have been used domestically. In my opinion, if U.S. pure fuel costs rise within the coming weeks, winter climate is more likely to be an even bigger driver than LNG exports.

Wouldn’t Russia hurt its personal financial system by reducing off fuel exports to Europe and shedding these revenues?

In recent times, Russia has structured its federal price range in a way that has allowed it to stash away US$630 billion in international trade reserves – money held by the central financial institution in different currencies for discretionary use, very similar to particular person financial savings accounts. Russian leaders can use these funds to climate any new sanctions or sudden adjustments within the worth of oil.

For instance, final 12 months, the Kremlin primarily based its spending on a conservatively low break-even oil worth estimate of $45 per barrel, giving itself some latitude. In the end, 2021 oil costs averaged $71 a barrel, offering a large budgetary windfall.

By this fiscal technique, Russian President Vladimir Putin has amassed a struggle chest to face up to any new spherical of sanctions, and even the entire lack of pure fuel export revenues from Europe for a time frame.

The 87-story Lakhta Heart, headquarters of Russian fuel monopoly Gazprom, in St. Petersburg, Russia.

Nonetheless, any Russian transfer to chop off fuel exports to Europe might need longer-term penalties. Putin might have hoped that his saber-rattling about pure fuel, and the excessive costs it has triggered, would persuade Europeans that Russian fuel is significant and might’t be simply changed with renewable power. However mockingly, this tactic might have already got created an enduring distaste that fast-tracks Europe’s pivot to offshore wind, Euro-North African hydrogen hubs, and U.S. LNG.

Gazprom, the Russian agency with the most important fuel export footprint in Europe, may additionally discover itself adrift in a sea of lawsuits and excessive penalty costs for breaking its contractual commitments within the wake of a cutoff. That in flip may have an effect on the Russian folks, who additionally depend on Gazprom’s solvency for his or her winter gasoline for heating.

Putin could also be keen to guess that an power pricing disaster in Europe will sow fashionable discontent, scotch the power transition and assist Russia win concessions on NATO’s positioning of troops and missiles. However there may be little proof that Europe will react that means. Whereas Europe’s shift to renewables will take time, it's going to nonetheless be dangerous information in the long term for Russia, which has 1,688 trillion cubic ft of pure fuel reserves left to be exploited for as a lot as 100 years of provide.

Written by Amy Myers Jaffe, Analysis professor, Fletcher College of Regulation and Diplomacy, Tufts College

This text was first printed in The Dialog.![]()

Post a Comment